In the first half of 2025, the EU and the United States are weakened by trade tensions, while in Canada and Brazil, supply is increasing and exports remain strong. In Asia, China continues its slowdown, with authorities regulating the market. Vietnam is boosting its supply, in contrast to South Korea, which is affected by heat waves.

Europe and North America : tense outlook

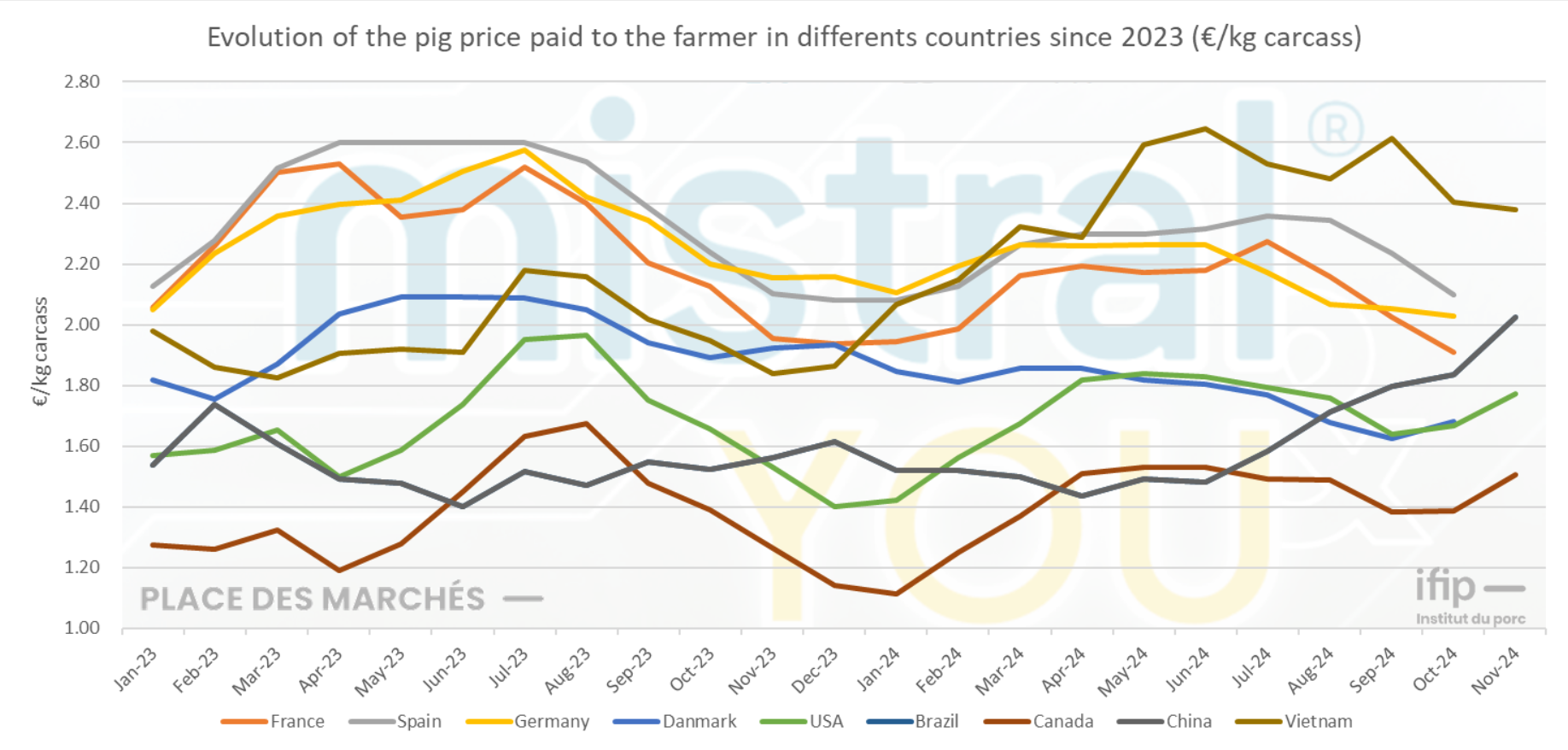

In Europe, pig production increased by 1.6% in the first half of 2025 compared to 2024, driven by Spain (+5.1%), supported by live animal flows from neighboring countries. European exports rose slightly (+2.1%) but show no strong signs of recovery. Prices show a marked contrast: after downward pressure from Northern European slaughterhouses, France and Spain were forced to lower prices in August. European competitiveness remains weakened by limited external demand and the appreciation of the euro. Outlooks darken with the first unfavorable conclusions of China’s anti-dumping investigation, which point to higher taxes on European pork, further increasing price pressure. With stable herds in Germany, Denmark, and the Netherlands, supply will be sufficient, suggesting downward price trends toward the end of the year.

In the United States, prices remained above 2024 levels this summer, supported by tight supply (slightly lower slaughter numbers, low cold storage inventories, and a resurgence of PRRS cases). However, this firmness is limited by lackluster domestic consumption. Internationally, exports fell by 3.6% in the first half of 2025 compared to 2024, penalized by President Trump’s trade policies and competitiveness lower than that of Brazil. In the short term, prospects point to restricted supply, with a slight decline in the sow herd and ongoing PRRS issues. This reduction in supply could, however, be offset by declining external demand in most markets, except in Mexico, where imports remain strong.

Canada and Brazil : confident through year-end

In Canada, supply increased by 2.8% over the first seven months compared to 2024, with prices supported by the strength of the U.S. market and the export of weanlings to the United States. Trade tensions between the two countries continued, but pork was exempt from tariff hikes. Canadian exporters are diversifying their markets, particularly toward Japan (+26.8% in the first half of 2025/24) and Mexico (+9.7%). With a projected rise in farrowings (+0.8%), supply is expected to continue growing, offering positive export prospects.

In Brazil, momentum remains strong: slaughter numbers rose by 2.5% in the first half of 2025 compared to 2024, and exports jumped 13.2% over the first seven months of 2025/24. While China has been less supportive, volumes were redirected to other markets (Philippines, Chile, Japan, Mexico). The country thus reinforces its position as a key supplier on the international stage, with positive signals expected through year-end.

Asia : uncertainties and vulnerabilities

In China, consumption remains cautious and prices are falling sharply, reflecting abundant supply and heavy carcasses. Authorities are intervening through stockpiling and herd regulation. Internationally, the new postponement of tariff negotiations with the United States until November 10, along with the announcement of provisional measures on European pork, is maintaining an atmosphere of uncertainty. China is very likely to stay on the sidelines of international purchases in the coming months, favoring its most competitive suppliers.

In Vietnam, the herd is growing (+3.8% in Q2 2025 compared to 2023), strengthening supply, while live pig prices have been declining since June. Consumption remains strong, and imports are rising (+23% in the first half of 2025/24) to compensate for production still constrained by health risks. A price increase is expected ahead of the mid-autumn national holidays.

In South Korea, supply is contracting (−3% over eight months), affected by heat waves that have slowed growth and increased pig mortality. Prices are firming, but limited purchasing power and a drop in foodservice consumption are restraining import demand (−4.7% over the first six months of 2025/24). However, year-end could bring seasonal support, and South Korea may make occasional purchases to offset its supply deficit.

Sources : Place des marchés by IFIP- Institut du Porc (French swine institute). Based on data from the European Commission (EU, Germany, Denmark), national sources (France, Spain), USDA LMPR report (USA), Statistics Canada (Canada), CEPEA (Brazil), 3tres3 (China, South Korea), and Genesus (Vietnam).